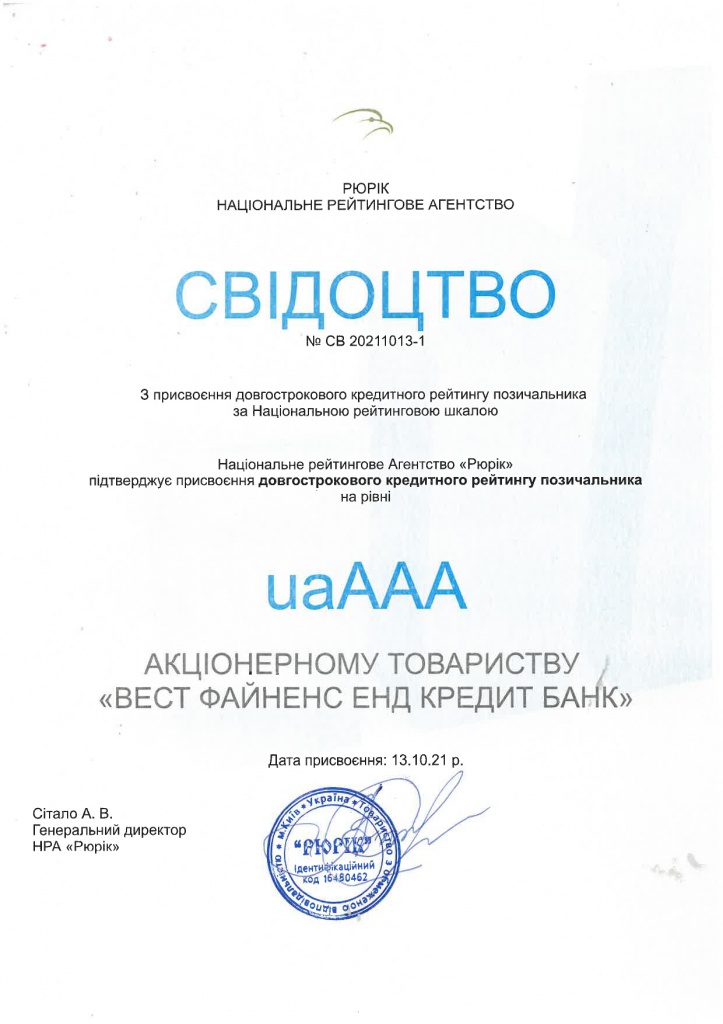

JSC "CREDITWEST BANK" was assigned a long-term credit rating at the level of "uaAAA"

About us

On October 13, 2021, the authorized National Rating Agency "Rurik" assigned a long-term credit rating of the borrower JSC "CREDITWEST BANK" on a national rating scale at the level of "uaAAA" investment category with "Stable" forecast, indicating the highest level of investment class of the Bank.

During the rating assessment, the most significant factors affecting the credit rating level of a banking institution were summarized, namely:

· High level of support from the owner. The multidisciplinary international company Altınbaş Holding INC is the owner of 100% participation in the Bank's capital;

· High liquidity ratios of the Bank. As of October 1, 2021, the level of coverage of current liabilities by highly liquid assets was 206% (recommended minimum 80%), and liquidity ratios of LCR and NSFR were carried out with a reserve;

· Sufficient quality of the client loan portfolio. As of October 1, 2021, loans to legal entities of 1-6 grades corresponded to 66% of the client's loan portfolio;

· Significant share of term funds of clients (53% of the portfolio of clients' funds as of October 1, 2021), which reduces the Bank's sensitivity to liquidity risk;

· Sufficient level of protection of assets with equity. As of October 1, 2021, the level of coverage of assets and loan and credit-investment portfolio with equity was 22% and 39%, respectively;

· Cooperation with international Financial Organizations. Attracting funds from international creditors provides the Bank with a cheap long-term resource and allows to diversify the resource base;

· High level of financial transparency and information openness of the Bank, that reflected in the detailed and comprehensive disclosure of information needed to determine the credit rating. This allowed reducing the degree of uncertainty in the assessment of creditworthiness and analysis of financial and economic activities of the Bank.

Cash exchange rates

| Currency | Buying | Selling |

|---|---|---|

|

USD |

41.1000 | 41.3500 |

|

EUR |

44.7000 | 44.9900 |

|

TRY |

1.2500 | 1.3500 |

|

PLN |

10.3500 | 10.5500 |

|

CHF |

46.5000 | 47.0000 |

|

GBP |

52.7500 | 53.5000 |

|

HUF |

0.1100 | 0.1180 |

|

CAD |

29.3000 | 29.8000 |

|

JPY |

0.2450 | 0.2650 |

|

CNY |

5.3500 | 5.5500 |

|

AUD |

26.7500 | 27.0000 |

|

BGN |

22.5000 | 23.0000 |

|

CZK |

1.7400 | 1.8000 |

|

ILS |

10.0000 | 10.5000 |

|

RON |

8.6000 | 8.9000 |

Non-cash exchange rates

| Currency | Buying | Selling |

|---|---|---|

|

USD |

41.1000 | 41.3000 |

|

EUR |

44.6000 | 44.8500 |

Cross currency rates

| Currency | Buying | Selling |

|---|---|---|

|

|

1.0840 | 1.0920 |

|

|

3.8500 | 4.0500 |

|

|

0.8700 | 0.8900 |